About

At Marlin Branstetter Attorney at Law, we handle claims related to:

- Identity theft or collector harassment

- Predatory lending and mortgage fraud

- Product safety and medical privacy

- Unwanted solicitations

1475 S. State College Boulevard

Suite 210

Anaheim, California 92806

Teléfono : 714-635-4234

At Marlin Branstetter Attorney at Law, we handle claims related to:

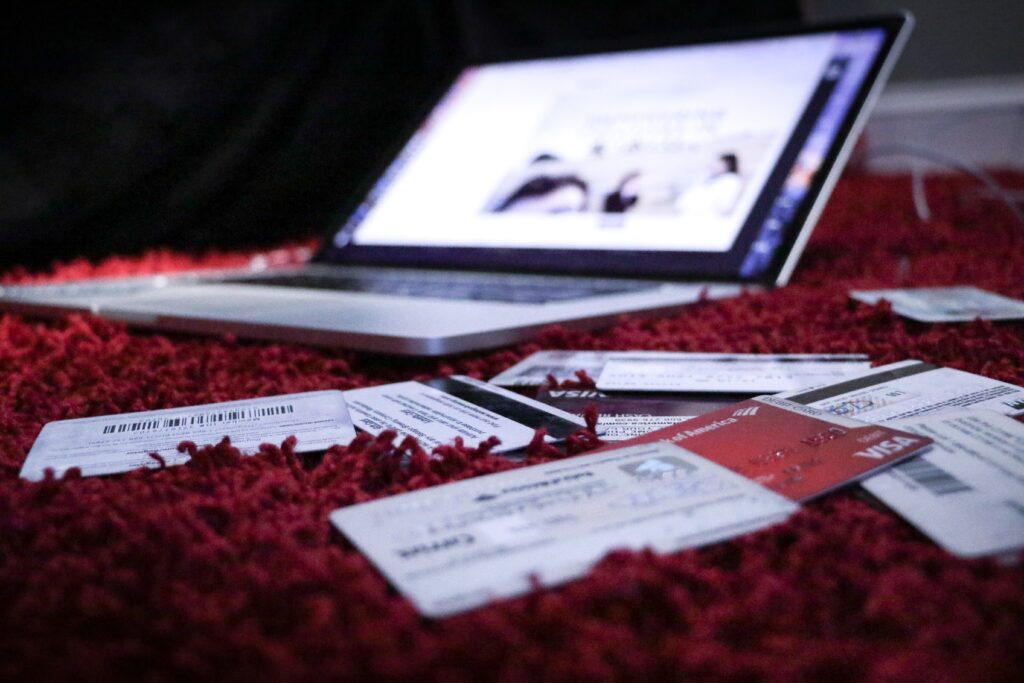

Identity theft and fraudulent charges can ruin your rating. If you have been a victim of identity theft, we can help clear your good name with reporting agencies. In addition, we can put a stop to abusive collections calls. Our firm handles claims involving the:

If you have been a victim of unethical or predatory lending practices, seek the advice of counsel at our firm. We help people like you fight back against fraudulent practices related to payday loans, refinancing, home mortgages and unconscionable interest rates. We litigate claims relating to the:

Identity theft and fraudulent charges can ruin your rating. If you have been a victim of identity theft, we can help clear your good name with reporting agencies. In addition, we can put a stop to abusive collections calls. Our firm handles claims involving the:

Registrants with the U.S. National Do Not Call Registry have a right not to receive unsolicited calls from telemarketers. If you have registered and your right has been violated, our attorneys can help you take legal action to assert and enforce this right.

Contact us today to schedule a consultation

At Marlin Branstetter Attorney at Law, our attorneys are skilled consumer protection lawyers who can help you settle the matters that have ruined your credit rating or caused you to suffer physical harm. Get the advice you need to seek the legal remedy you deserve when you call or contact us online today. Our office is conveniently located in Anaheim, California.

1475 S. State College Boulevard

Suite 210

Anaheim, California 92806

Phone : 714-635-4234

Fax: 714-635-4334